IP BOX regimes in general, and Cyprus’s IP BOX in particular, are trending in the international tax sector due to their obvious advantages.

But what exactly is an IP BOX regime?

Can your business project benefit from it?

What advantages does Cyprus’s IP BOX offer and why is it currently so famous?

While the IP BOX is a complex and technical subject, our goal in this article is to help you understand in simple terms what it is and how it could benefit you.

What is the IP BOX?

In recent decades, various countries have developed attractive programs tax-wise for assets categorized under this Intellectual Property or Patent label.

The logic is simple: it offers lower taxes on income derived from royalties, licenses, patents, sales of these assets, etc.

The goal of countries developing an IP BOX is twofold: to attract such investments and innovative projects and to incentivize research and development (R&D) among current residents.

In general terms, Intellectual Property includes assets such as software, patents, proprietary formulas, utility and manufacturing models, innovative works, etc.

However, each country determines which assets are eligible under its IP BOX.

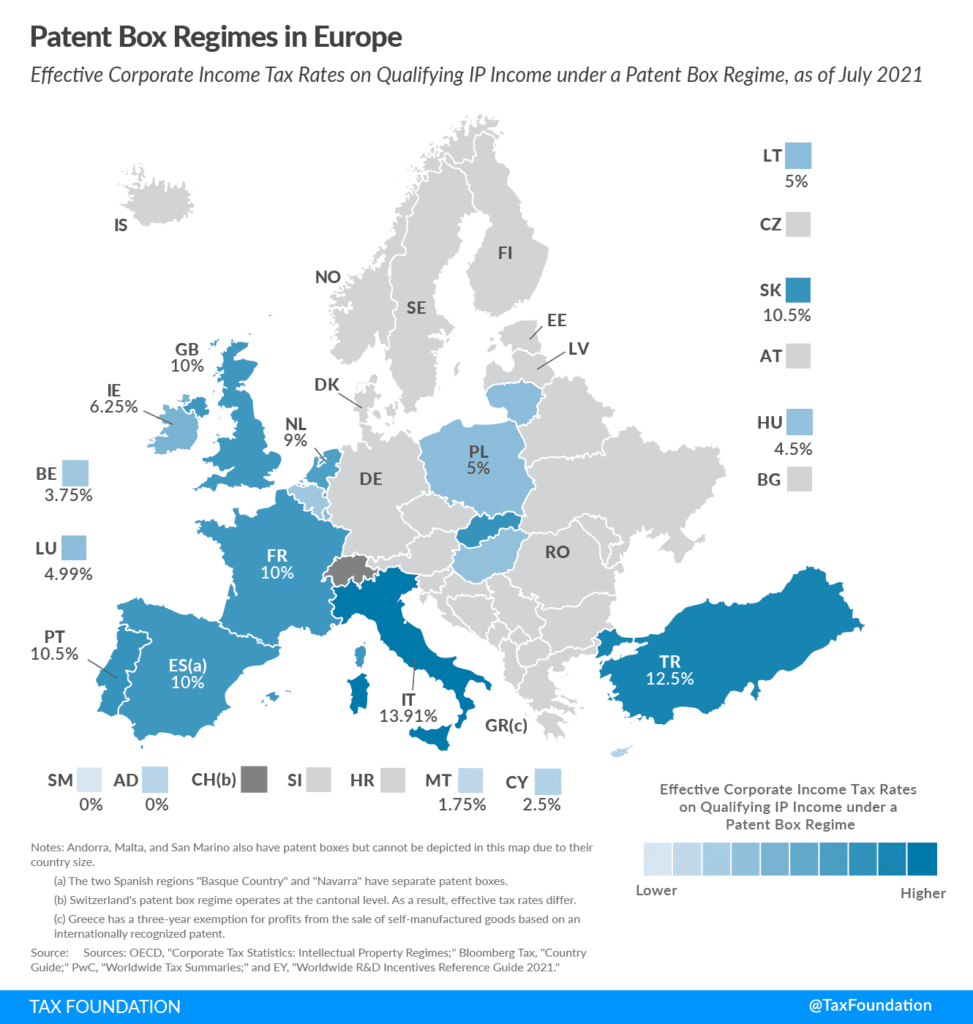

In Europe, we find numerous examples of IP BOX regimes such as Belgium, Hungary, Luxembourg, and the Netherlands.

The reason we focus on Cyprus IP BOX today is that its characteristics and advantages (with an effective rate as low as 2.5%) make it the most attractive IP BOX regime.

Cyprus IP BOX: Advantages and Taxation

The general Corporate Income Tax rate in Cyprus is 12.5%.

Cyprus IP BOX regime allows 80% of the profits deemed qualified for IP BOX purposes to be exempt from tax.

This tax benefit results in a significantly reduced effective rate of 2.5%, and potentially even lower effective rates thanks to the amortization (up to 20 years) of development or acquisition expenses.

It’s important to note that this exemption applies to profits connected with the qualified asset, so it’s always necessary to conduct a thorough analysis of operations and the monetary flows that would benefit under this regime.

Furthermore, not all qualified assets will result in a 2.5% rate on all the profits they generate. In some cases, the effective rate can be 5%, 7%, 9%, etc., depending on the Nexus formula.

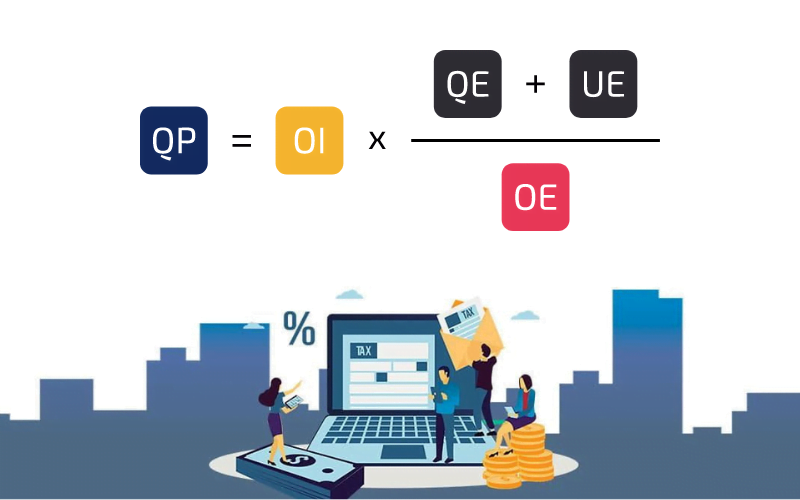

The calculation under the so-called “Nexus Fraction” helps determine what portion of the profits obtained from that intellectual property are derived from the R&D expenditure incurred by the entity benefiting from the patent box regime.

This concept is better understood with an example:

An entity that develops the intangible asset or intellectual property entirely from Cyprus can fully benefit from the IP BOX, while an entity that purchases the semi-finished asset from a third party and only develops part of it will only access a partial benefit from the IP BOX.

The goal is to determine the Qualified Profit (QP) by multiplying the Overall Income (OI) by the fraction of Qualified Expenditure (QE) plus Additional Expenditure (UE) over the Overall Expenditure (OE).

This calculation can be performed with the assistance of our advisors by contacting us.

Patents, Software, and Qualified Assets in Cyprus IP BOX

Not every type of asset or business model may qualify under Cyprus’s IP BOX.

It’s important to understand that, broadly speaking, the IP BOX applies to useful, innovative, non-obvious intangible assets.

Analyzing each business model is crucial to determine which of its assets, under development or to be developed, could qualify. Calculating the actual tax savings involves considering the monetary flows benefiting from the regime.

Given its popularity, Cyprus’s IP BOX is often misunderstood and misapplied as a universal tax solution.

Remember, obtaining a favorable tax ruling from the tax authorities doesn’t guarantee 100% applicability of the IP BOX unless fully justified.

We strongly recommend seeking thorough guidance to ensure that your IP BOX application aligns with qualified assets, such as:

- Utility models and intellectual property like medicines, proprietary formulas, manufacturing models…

- Software, mobile applications, computer programs…

- Trade secrets, technical know-how, and other non-obvious, useful, innovative intangible assets.

These qualifications apply as long as the entity does not generate annual gross income exceeding seven million five hundred thousand euros (€7,500,000) from all intangible assets. In the case of a group, the group’s total should not exceed fifty million euros (€50,000,000).

Assets expressly excluded from Cyprus’s IP BOX include:

- Image rights

- Trademarks

- Trade names

- Other rights used for marketing products or services.

How to Apply for the IP BOX in Cyprus

- A Cypriot company must develop the intellectual property asset or have economic ownership acquired under market conditions.

- The Cypriot company must demonstrate control over the asset and assume related risks, being responsible for research and development.

By providing Cyprus tax authorities with a detailed study of the company’s activities, a favorable Tax Ruling can be requested, indicating the company’s eligibility for IP BOX application.

It’s important to note that this Tax Ruling from authorities does not guarantee IP BOX applicability if subsequent audits reveal fraudulent use.

Therefore, we emphasize the importance of personalized guidance for preparing and submitting this study.

Cyprus IP BOX regime review

In our experience, the popularity of Cyprus’s IP BOX is justified by its flexibility and advantages compared to other similar regimes.

This adds to the numerous benefits that place Cyprus among the top countries for Tax Nomads in the European Union:

Are you interested in applying for Cyprus IP BOX or setting up a company in Cyprus?

Or would you prefer a complete analysis of your situation to discover the best option for you?

In either case, we can help!

Simply request your FREE INITIAL CONSULTATION BY CLICKING HERE, or contact us directly via WhatsApp or through the form below.

Contact us

Countries like Cyprus have implemented this regime to attract investments and promote research and development (R&D).

Cyprus’s IP BOX significantly reduces the tax burden on intellectual property (IP) income:

- General Rate: 12.5% corporate tax.

- IP BOX Exemption: 80% of qualified profits are exempt, lowering the effective tax rate to 2.5%.

- Amortization: Development or acquisition expenses can be amortized over up to 20 years.

- Nexus Fraction: Calculates the proportion of profits attributable to R&D, adjusting the effective rate between 2.5% and potentially higher, depending on R&D expenditure.

In summary, Cyprus IP BOX can reduce the effective tax rate to as low as 2.5% for income derived from IP.

Opening a company in Cyprus costs approximately 2,500 euros.

If you want to include the IP BOX regime, the additional cost for the complete process is around 3,000 euros (including application fees of approximately 1,200 euros).

These prices vary depending on the services and advice required for incorporation and the application of the IP BOX regime.

Assets that qualify under Cyprus’s IP BOX primarily include:

- Utility models and intellectual property such as medicines and proprietary formulas.

- Software and mobile applications.

- Trade secrets and know-how.

These assets must be innovative, useful, and non-obvious.

However, image rights, trademarks, and trade names used for marketing products or services are explicitly excluded from the IP BOX regime.

To apply for the IP BOX in Cyprus:

- The company must develop or have economic ownership of the asset.

- It must demonstrate control and assume related risks.

- Provide a detailed study to the tax authorities.

- Request a favorable Tax Ruling.

It is crucial to obtain specialized advice for preparing and submitting the study.