If you’ve visited our Blog or Social Media, you probably already know why Cyprus is our tax residence.

We have numerous articles on the advantages of tax residence, taxes and costs of a company in Cyprus or its non-dom regime.

But we haven’t answered a very common question among those Tax Nomads interested in this country…

Is it better for me to register as self-employed or to open a company?

This question is especially relevant for profiles like “digital nomads” or “freelancers” who don’t have very high annual revenue or a large business structure that would require using a company.

So… What’s better? Let’s find out!

Taxes as a self-employed person in Cyprus

Personal Income Tax (PIT)

The first thing to consider is that as a self-employed individual, all your profits will be taxed under Cyprus’ Personal Income Tax (PIT).

And we’re off to a bad start because this tax is the WORST the country has (although it’s certainly much better than the tax hells like Spain or Germany)

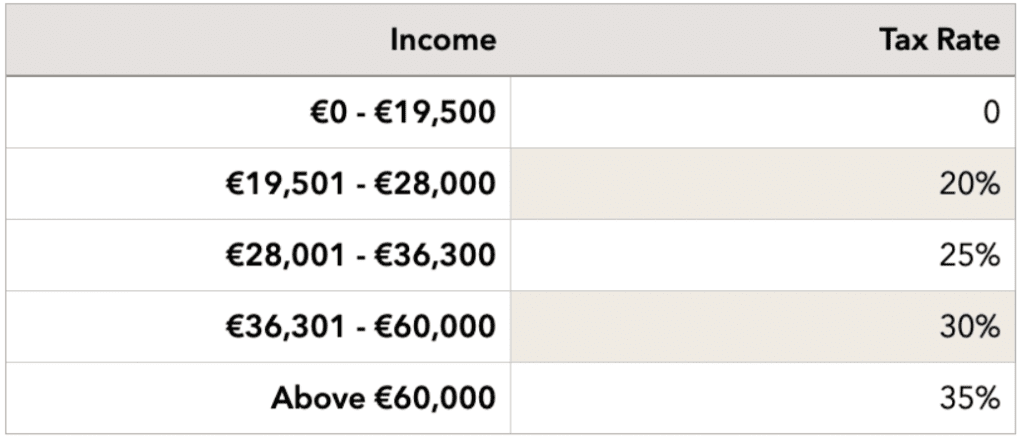

Specifically, Cyprus’ PIT is a progressive tax where you would be taxed according to this scale based on your total income:

The good news is that, if we look, up to €19,500 the PIT is 0%.

This gives us a very interesting margin and provides initial clues about who will find it beneficial to invoice as a self-employed individual or through a company.

Social Security Contributions for self-employed in Cyprus

On the other hand, self-employed individuals registered in Cyprus must mandatory join the Social Security scheme and the GESY (Public Health System).

Currently, Social Security contributions must be paid every 3 months and consist of a total of 20.4% of the estimated income of the self-employed (16.4% for Social Security and 4% for GESY).

Initially, Social Security will determine how much the self-employed person must pay quarterly based on estimations from their professional activities.

However, it is possible to arrange a simple procedure to pay this percentage based on the self-employed person’s actual income.

The minimum “quota” is around €190 per month.

VAT for self-employed individuals

Cyprus VAT is 19%, but in this case, there are no significant differences between self-employed individuals and companies. The rules are:

- It is mandatory to register for VAT purposes if turnover exceeds €15,600 annually.

- You can simultaneously register as an Intracommunity VAT operator (EU) and issue invoices without VAT B2B within Europe.

- VAT returns are required quarterly.

VAT is a complex and changing matter depending on your business, clients, and locations…

We strongly recommend seeking tax advice if you have doubts about how VAT operates in your business model.

More information and specifications on VAT in Cyprus.

In any case, as we mentioned, VAT will not be a decisive factor as much as PIT and social security contributions.

Next, we will see more advantages of each option:

Advantages of being self-employed or having a company in Cyprus

Now that you know the most relevant taxation for self-employed individuals on the island, it’s time to compare the key advantages of both options.

The most significant advantage of registering as self-employed or self-employed lies in the low initial costs:

- You may only need assistance with your immigration records, social security, and non-dom regime.

- You don’t need to register the opening of a company.

- You don’t need to undergo annual audits (as long as you stay below €70,000 annually).

- You won’t have some maintenance costs like the municipal tax on companies.

The most important advantage of registering as a company is the low taxation as you scale up:

- Although there are some initial costs (if you do it with us, you get the best price in Cyprus), taxation is much lower.

- You don’t pay under PIT. It’s a Corporate Tax of 12.5%.

- You don’t have to pay 19.6% Social Security on all income.

- These tax benefits more than outweigh the maintenance costs as turnover starts to grow.

- Dividends received from your own company benefit from the Non-Dom tax exemption.

- You can take a small salary and benefit from Cyprus Social Security without paying PIT.

- Easy creation of advantageous tax structures with other offshore companies as no withholding tax applies to Cypriot companies.

Registering as self-employed or opening a company in Cyprus?

Many Digital Nomads arrived on the island and registered as self-employed with approximate monthly earnings of €1,500.

Within this range, social security contributions can remain low, and personal income tax (PIT) may not apply yet.

However, being in Cyprus, they have been able to scale their businesses and have opened a company to benefit from lower taxation.

In conclusion, taking into account all factors previously discussed, in Cyprus, it becomes truly advantageous to operate through a company starting from around €30,000 annual profit.

Certainly, there may be nuances and other reasons (such as trademark registration, anonymity, reputation, or ease of obtaining financing with a company) that influence the decision for either option below/above that figure.

But from a tax and cost perspective, as our earnings scale to around €2,500 monthly or more, operating with a company and receiving dividends increasingly becomes more advantageous.

Are you interested in obtaining tax residency or setting up a company in Cyprus?

Or would you prefer a complete analysis of your situation to discover the best option for you?

In either case, we can help!

Simply request your FREE INITIAL CONSULTATION BY CLICKING HERE, or contact us directly via WhatsApp or through the form below.

Contact us

A self-employed person in Cyprus pays Personal Income Tax (PIT) with a progressive scale.

Additionally, they must comply with social security contributions of 20.4% (16.4% Social Security and 4% GESY).

VAT is 19%, registration required only if annual turnover exceeds €15,600, and it applies on a quarterly basis.

There is no withholding tax on Cypriot companies, making it easier to create advantageous tax structures with other offshore companies.

The main advantage of being self-employed in Cyprus lies in the low initial costs.

There is no formal requirement to open a company or undergo annual audits (if income is below €70,000).

Maintenance costs compared to having a company in Cyprus are also lower.

It’s an attractive option for those with modest initial income.

Opening a company in Cyprus offers significant tax advantages as income scales up. The low taxation, with a Corporate Tax rate of 12.5%, outweighs initial costs.

There is no 19.6% Social Security contribution on all income, and dividends can benefit from the Non-Dom tax exemption.

It facilitates the creation of advantageous tax structures and is particularly beneficial when annual income reaches €30,000 or more.